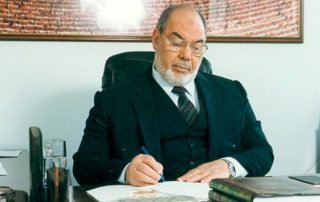

H.E. Prof. Koutoub Moustapha Sano, Secretary General of the Academy, delivered the opening speech at Al Qasimia University’s International Conference titled “Investment in Gold: Practices and Challenges: A Sharia Economic Vision.” Held under the patronage of His Highness Sheikh Dr. Sultan bin Muhammad Al Qasimi, Member of the UAE Supreme Council and Ruler of Sharjah, the conference took place on Wednesday, 17 Shawal 1446, corresponding to 16 April 2025, in Sharjah, United Arab Emirates.

At the opening session, His Excellency began his speech by stating: “First, I am pleased to convey the greetings of your esteemed organization, the International Islamic Fiqh Academy, its Presidency, Members, Experts, and Affiliates—and to express our deepest gratitude to the leadership and people of the United Arab Emirates for their continued support to the Academy, particularly to the Emirate of Sharjah, the Emirate of Science, Thought, Culture, and Heritage. We also extend our appreciation for sponsoring this timely and crucial conference on a vital and significant field. Gold investment is among the most important areas of safe and reliable investment, one which Islam, centuries ahead of economists and financial scholars, has encouraged through buying and selling.”

His Excellency then addressed the challenges facing the world today: “It goes without saying that our world today is marked by escalating intellectual turmoil, deepening social crises, growing economic volatility, unprecedented geopolitical shifts, rapid technological transformations, and relentless regional and international tensions. The plight of occupied Palestine, especially Gaza, remains ever-present” His Excellency explained that these socio-economic crises and geopolitical and technological changes are “the dire conditions and grim realities driving individuals and nations to invest in gold as a symbol of wealth and stability, a store of value, a medium of exchange, and a secure hedge against inflation and risk, thanks to the unique qualities Allah has bestowed upon it, such as rarity, symbolism, and tradability.”

While the world has only recently recognized the importance of gold investment as a strategic tool against currency fluctuations, His Excellency noted, “Islam was centuries ahead in urging investment in gold and silver, emphasizing their significance. It even prescribed severe consequences for hoarding them without spending in Allah’s way, as stated in the verse: ‘O you who believe! Indeed, many of the rabbis and monks consume people’s wealth unjustly and turn them away from Allah’s path. And those who hoard gold and silver and do not spend it in Allah’s cause—give them tidings of a painful punishment. On the Day it will be heated in the Fire of Hell and their foreheads, sides, and backs branded with it: “This is what you hoarded for yourselves, so taste what you used to hoard.”‘ (Qur’an 9:34-35). His Excellency stressed that *”withholding gold and silver from Allah’s cause constitutes hoarding, preventing them from fulfilling their divine purpose: circulation, growth, justice, preservation, and the well-being of individuals, society, and the Ummah”

His Excellency further elaborated on the prophetic ahadith that establish Sharia rulings on investing in gold and silver, as they fall under riba induced (usurious) wealth. Among the most significant hadiths is that of the esteemed companion Ubada ibn al-Samit (may Allah be pleased with him), who narrated that the Prophet (PBUH) said: “Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates, and salt for salt—like for like, hand to hand. Whoever increases or seeks an increase has engaged in usury, and both the giver and taker are equally guilty.” His Excellency emphasized that this hadith and others like it outline key Sharia principles for investing in usurious wealth, particularly gold and silver, including ownership, equivalence, and immediate exchange. His Excellency concluded: “These three principles are paramount in gold and silver investment. All other practices and contracts must be measured against them—those in alignment are valid, while those contradicting them are rejected. In essence, these rules serve as the benchmark for evaluating new gold investment methods in addition to a constellation of ethical standards, represented by commitment to honesty, trustworthiness, loyalty, integrity, justice, tolerance., as well as other moral virtues that the Muslim investor should be adorned with at all times.”

At the end of his speech, His Excellency urged scholars to turn to jurisprudential councils under the International Islamic Fiqh Academy’s leadership to conduct thorough, collective ijtihad on this issue, clarifying Sharia rulings while addressing risks, market mechanisms, and ethical-legal frameworks.

The conference featured fifty-four participants from over twenty countries, who presented forty-seven peer-reviewed papers examining gold investment from jurisprudential and economic perspectives, with a focus on Sharia compliance, global market challenges, and regulatory frameworks.

Read Also

Lastest