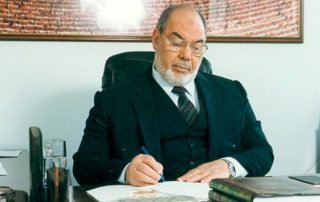

H.E. Prof. Koutoub Moustapha Sano, Secretary General of the International Islamic Fiqh Academy, participated in the 11th Doha Islamic Finance Conference on “Blockchain Integration, Artificial Intelligence and the Future of Islamic Finance”, held under the patronage of H.E. Sheikh Mohammed bin Abdulrahman bin Jassim Al Thani, Prime Minister and Minister of Foreign Affairs, with the participation of numerous local and international financial organizations and institutions, at the Ritz-Carlton Hotel in the city of Doha, on Tuesday 8 April 2025.

The Secretary General began his speech with praise and thanksgiving to Allah and sending blessings and peace upon the best of His creation, Prophet Muhammad (PBUH), then expressed his gratitude and appreciation to the Qatari leadership and people for their hospitality, expressing his deepest thanks and appreciation for inviting him to participate in this important conference, particularly to Dr. Osama Al Durei, CEO of Bayt Al Mashura, for his outstanding efforts in organizing this important and timely high-level conference.

In his speech, His Excellency stressed that the digital revolution witnessed by the contemporary world “is not a temporary boom, but a profound transformation and development that requires new approaches, flexible perceptions, and realistic responses. The world is rapidly moving towards accelerated transformations led by artificial intelligence and blockchain technologies, therefore, talking about the future of Islamic finance amid these changes is a responsible conversation. Given that it is an integrated economic model that combines originality and contemporaneity, economic efficiency and value credibility, and is based on lofty goals that make it a comprehensive system that aims to promote wealth, and its prosperity, achieve justice in its distribution, ensure clarity in its earning, protect rights in it, and preserve it from any aggression, in order to achieve comprehensive well-being for the individual, society, nation, and the world.” His Excellency emphasized that “the five objectives of investing money in Sharia are not separate from the spirit of the current technological revolution, but rather harmonize with it, because they direct it towards serving man rather than exploiting him, using money rather than sanctifying it, and achieving happiness rather than spreading misery. Therefore, the future of Islamic finance cannot be separated from the future of these new dynamics that have changed the contours of markets, reshaped investment concepts and created unconventional tools for exchange, contracting and financial planning. Today, more than ever, we are recalled to prudently revisit several traditional methods of financing and investment in order to explore new horizons of efficiency, transparency and innovation.”

His Excellency also said, “These technologies represent a strategic opportunity to develop Islamic finance and increase its efficiency,” he said, noting the importance of using blockchain technology to enter into and implement Sharia contracts such as murabaha, mudaraba, ijarah and musharaka, in accordance with collective resolutions and Sharia norms, without the need for intermediaries, fear of gharar, and delays in execution, to achieve the realization of the principles of Islamic finance. In addition, it can be used to manage Islamic sukuk intelligently and accurately by issuing smart sukuk that follow the movement of assets and react to their changes in real-time, increasing the efficiency of control and audit, and achieving greater transparency and reliability.” His Excellency then spoke about the importance of getting the best out of artificial intelligence, which he described as “truly the miracle of this age, with its extraordinary ability to analyze a huge amount of data and extract accurate insights that contribute to making more rational and consistent financing and investment decisions compliant with Sharia. Therefore, this intelligence can be used to improve risk assessment processes, provide specialized financial advice, enhance Sharia supervision and auditing by detecting any deviation from collective resolutions and Sharia norms, improve Sharia governance, reinforce Sharia compliance, and increase confidence in Islamic financial institutions”.

Furthermore, His Excellency clarified that benefiting from the integration of these two technologies represents a golden opportunity to restructure the entire Islamic financial system on new foundations that combine analytical intelligence and technological security, between vision and implementation, and between flexibility and discipline. He pointed out that this hoped-for integration “can only be achieved through a comprehensive vision and a strong regulatory framework that preserves the valuable identity of Islamic finance and ensures the responsible and enlightened use of modern technologies. It also requires the preparation of scientific competencies and the qualification of human cadres who have a deep understanding of Sharia, a broad awareness of technology, and the ability to harmonize the two. Therefore, cooperation between various components of the Islamic financial system (represented by the infrastructure institutions of the Islamic financial industry, regulators, banks and financial institutions, and technology companies) is urgently needed to create a supportive environment for Islamic finance. We hope to create an environment that supports innovation, encourages experimentation and ensures Sharia compliance.”

At the end of his speech, His Excellency concluded by saying, “We hope that this amazing conference will be a real beginning of a qualitative change in the march of Islamic finance, and that its discussions will lead to the construction of mature scientific visions and effective practical results that will restore Islamic finance in general and Islamic finance in particular to its ethical and missionary role, revive humanism within economy, achieve comprehensive well-being for the individual and society, and promote the desired and lasting integration between Sharia and reason, between originality and modernity, between wisdom and innovation, and between words and deeds.”

It is worth noting that this conference was attended by researchers and pioneers of the Islamic finance industry in Qatar and from abroad.

Read Also

Lastest