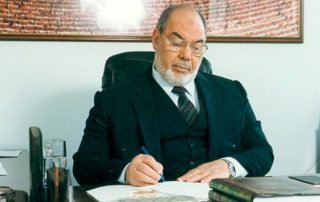

His Excellency Prof. Koutoub Moustapha Sano, Secretary General of the International Islamic Fiqh Academy (IIFA), delivered a lecture within the series of public lectures at the School of Oriental and African Studies, University of London, the United Kingdom, via Zoom technology, on Wednesday 16 Dhul Qi’dah 1443H corresponding to 15 June 2022G. The title of this year’s public lecture was: “Cryptocurrencies: How Will Islamic Finance and Islamic Jurisprudence Adapt to the New Economic Paradigm?”

At the outset, His Excellency Dr. Jonathan Ercanback, Head of the Center for Islamic and Middle Eastern Law at the School of Oriental and African Studies, University of London, and the organizer of the session welcomed His Excellency the Secretary General of the Academy, stressing the importance of involving Muslim scholars in the debate on the role of Islamic finance and Shariah in the course of the Islamic financial industry. This was followed by the intervention of the Director of the Public Lecture Sir Ross Cranston, former High Court Justice and Visiting Professor at the London School of Economics, University of London who stated that although the topic of discussion this year was challenging for all parties involved, it would provide a good opportunity to understand how Islamic finance contributes to the financial market in general. Then Sir Ross Cranston introduced His Excellency Professor Sano as an international jurist and a distinguished legal scholar.

His Excellency began his intervention by thanking and praising the organizers for the accuracy of their selection of the topic of this year’s public lecture series, and its major repercussions on the financial market and on Muslims all over the world. Within the framework of the public lecture titled: “Cryptocurrencies from a Jurirtic Perspective: Presentation and Analysis”, His Excellency highlighted the importance of differentiating between the reality of encrypted digital currencies as means of exchange and dealing, and the areas of use of these currencies in speculation, transfers, and other things. He added: “In Facing the successive developments in the world of contracts and the continuous transformations in the methods and concepts of transactions, there is a need for a comprehensive and conscious vision that adheres to the general Islamic jurisprudence texts in issues of finance and business in the light of the noble purposes and objectives of Shariah, which are based on bringing benefit and warding off harm”. His Excellency explained that the general and secondary jurisprudence rules developed by Muslim jurists are capable of absorbing the developments, changes and transformations that we see today, adding that there is “a need to move away from interfering with the traditional jurisprudential heritage and searching through it for jurisprudential answers to new forms and patterns of contracts, transactions and sales that were not known , but rather it arose after the era of codification in the light of social, intellectual, economic and cultural contexts and developments different from the contexts and realities that prevailed when jurists codified their jurisprudence on many contracts and transactions.”

His Excellency also explained that the encrypted digital currencies are of the type of virtual money that arose over a decade ago, and the statement of the Shariah ruling on them with regards to permissibility or prohibition requires verification of the extent to which the description of money applies to them in Islamic jurisprudence. Referring to the definitions of money by jurists, we find that they call money everything that is used as a medium of exchange of benefits and prices and is acceptable to those who deal with it. Based on this perception of money, encrypted digital currencies are considered money in jurisprudence because today they are used as a medium and a means of exchange and dealing between its dealers. His Excellency indicated that considering a method of cash can be done through a central authority, as is the case in contemporary paper money such as the British pound and the US dollar, and it can be through customary arrangments among dealers, as is the case in digital currencies in general and encrypted digital currencies in particular. The source of reliance on the cash nature of these currencies is their acceptance by those who deal in them as a means of exchange of benefits and prices. His Excellency concluded that “a distinction must be made when clarifying the appropriate Shariah ruling for cryptocurrencies and the areas of their employment and use, and it is not correct to confuse the two matters like in all contemporary paper currencies, such as the pound and the dollar, it is not correct to judge the reality of those currencies and what they are used for. This means that the fluctuations and instabilities of cryptocurrencies in the world of speculation are not different from the fluctuations and changes in the stock market. Therefore, this basic matter must be considered, and a distinction must be made between cash money and digital money, and it is not prohibited to create new currencies that achieves the basic functions of money, especially the function of the medium of exchange and dealing between the contracting parties, the function of the authority to discharge debts, and the measure of value.”

The public lecture was followed by a live and interactive question-and-answer session, during which His Excellency answered the various questions and inquiries of the audience. It should be noted that the lecture was very popular, as it was attended by nearly 200 people in attendance and 50 other people virtually via the internet. The audience consisted of eminent scholars from various academic fields, including Islamic law, law and engineering, as well as muftis from within the UK’s Muslim community. In the end, the attendees were invited to a reception in honour of His exellency prof. koutoub Moustapha Sano the Secretary General of the Academy.

Read Also

Lastest