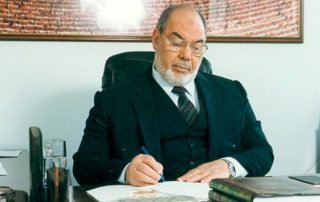

H.E. Prof. Koutoub Moustapha Sano, Secretary General of the Academy, delivered the opening speech at the Al Qasimia University Islamic Economics Forum entitled “Investment through Electronic Platforms: Applications, Challenges and Prospects” organized by the Sharjah Center for Islamic Economics on Wednesday, 28 Dhul Quidah 1445, corresponding to 05 June 2024 in Sharjah, United Arab Emirates.

His Excellency’s speech was titled “A Calm Look at Shari’ah-Based Solutions in Trading Stocks and Indexes via Electronic Trading Platforms.” He began by expressing his thanks and praise to the UAE’s leadership and people for the excellent care given to the Islamic economy and expressed his gratitude and appreciation to His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, Member of the Sharjah Islamic Economy Center, Supreme Council Member and Ruler of the Emirate of Sharjah, may Allah protect him for the care he gives to science, culture, and heritage beyond all description and for the attention he gives to education in particular, making the Emirate of Sharjah worthy of being aptly called the Emirate of Science, Ideas, Culture and Heritage, may Allah protect His Highness, his family, and all rulers of the UAE, as well as the Emirati people. His Excellency then congratulated Al Qasimi University, President of the University, H.E. Prof. Jamal Al Tarifi, Rector of the University, H.E. Prof. Awwad Al Khalaf, and Director of the Sharjah Center for Islamic Economics, H.E. Dr. Yasser Hassan Al Hosani, on the steady development and progress of the University and the Center in all aspects, especially the outstanding quality of its graduates who come from various countries around the world, as well as the accuracy and choice of the forum’s title which reflects the Center’s interest in the applied aspect of Islamic economics.

His Excellency then spoke about the concept of investment in Islamic theory as a concept that means “responsible, conscious and purposeful utlisation of money directly and indirectly in an economic activity that does not contradict the provisions and principles of the Sharia, to obtain a return from it to help him fulfill the task of succession in the earth and colonization of the universe.” He explained that investment is considered in Islam “an important act of behavior to which Islam has given great care and attention, as a means of preserving one of the total Sharia objectives and necessary interests, which is the purpose of preserving money.”

His Excellency also spoke about the general principles and general rulings that guide the methods of investment, guide its means, and rationalize its type of activity, the most important of which are flexibility, breadth, and the ability to keep pace, saying: “It is one of God’s mercies to the people that He has made these Sharia texts regarding investment characterized by flexibility, breadth, and validity for every time and place, in addition to the ability to keep pace with development and progress, and achieve happiness for man at every time and place.”

As for the methods, means and fields of investment, which are witnessing changes day after day and will not halt in growth, a decline in spread, or a retreat in expansion, but rather an increase in tools and a proliferation of fields, His Excellency said: “The intellectual responsibility of reporting and explaining, include the Ummah’s scholars and intellectuals, has become greater today than ever in order to guide its new developments and changes, in light of Sharia’s general principles and objectives. The scientific need to promote cooperation, convergence and integration between religious and urban scientists has become more urgent than at any time in the past, given the complexity, overlap and interconnectedness of these methods.” His Excellency then explained that formulating solutions and responding to changes and developments is “Guided by the consideration of principles, rules, purposes, outcomes, and controls, and in the light of the conceptualization, analysis, and investigation provided by the scholars of finance and economics, these solutions can be described as Sharia-compliant solutions, which are based on Sharia provisions, principles, rules, purposes, and controls for every new method and every new field.”

His Excellency emphasized that these solutions should be based on a faithful and sober consideration of the Shari’ah’s objectives related to wealth, which are represented in five things: “They are the circulation of money by keeping it in the hands of as many people as possible, the clarity of the ways of collecting and earning it by avoiding harm and deception, justice by collecting it and proving it to the rightful owner in a risk-free manner, and achieving comprehensive well-being for the individual, society and the world.” He emphasized that these purposes of money are the framework governing investment with its tools and fields. He emphasized that these maqasid related to wealth and property are the framework governing investment in all its fields and areas, and they are also the scale on which the jurisprudence of the scholars should be presented in the new investment methods, fields, and tools.

His Excellency then referred to the most appropriate way to resolve the complexities covering these issues: “The safe and solid formulation of these solutions should be confined to jurisprudential councils, whose members are composed of the leading scholars of the age specializing in the sciences of Sharia as well as in modern fields of knowledge who cooperate and consult each other. The International Islamic Fiqh Academy is hence considered the most important contemporary academy that spares no effort in carrying out this collective ijtihad”

Accordingly, His Excellency referred to several historical resolutions in this regard, saying: “Resolution No. 63/1/7 is the most important contemporary jurisprudential resolution that includes clear solutions for dealing with stocks and indexes. This resolution contains broad outlines of the Shari’ah-based solutions for general dealing with stocks and indexes. The reader of this resolution will find an arbitration of the general principles of Sharia regarding dealing with stocks as one of the contemporary transactions, so the general principle stating that the basis of transactions is halal applies to it initially. The reader will also find a precise determination of Shari’ah rulings concerning contracts and transactions in terms of the availability of elements and conditions, as it restricted the legitimacy of dealing in shares and indexes on the condition that the primary purpose of the company is not to deal in prohibited transactions such as usury and prohibited sales.”

His Excellency concluded his speech by saying: “Since the International Islamic Fiqh Academy clarified the rulings on dealing and investing in stocks and indexes, we can also clarify the Sharia ruling on investing in stocks and indexes through electronic trading platforms, recognizing from the outset that saying that investing in indexes is not permissible automatically entails bypassing the discussion on their ruling, taking into account that there is no difference between investing in these indexes through normal trading through brokers and investing in them through electronic trading platforms that are nothing more than websites..”

It is worth noting that the forum discussed four themes during its sessions on investing in stocks and indexes through electronic trading platforms, investing in digital currencies and forex through electronic trading platforms, contemporary experiments and smart applications in the field of investment through electronic trading platforms, and regulatory and legal challenges in the field of investment through electronic trading platforms.

The forum concluded with a final statement that included the most essential recommendations discussed in the event.

Read Also

Lastest